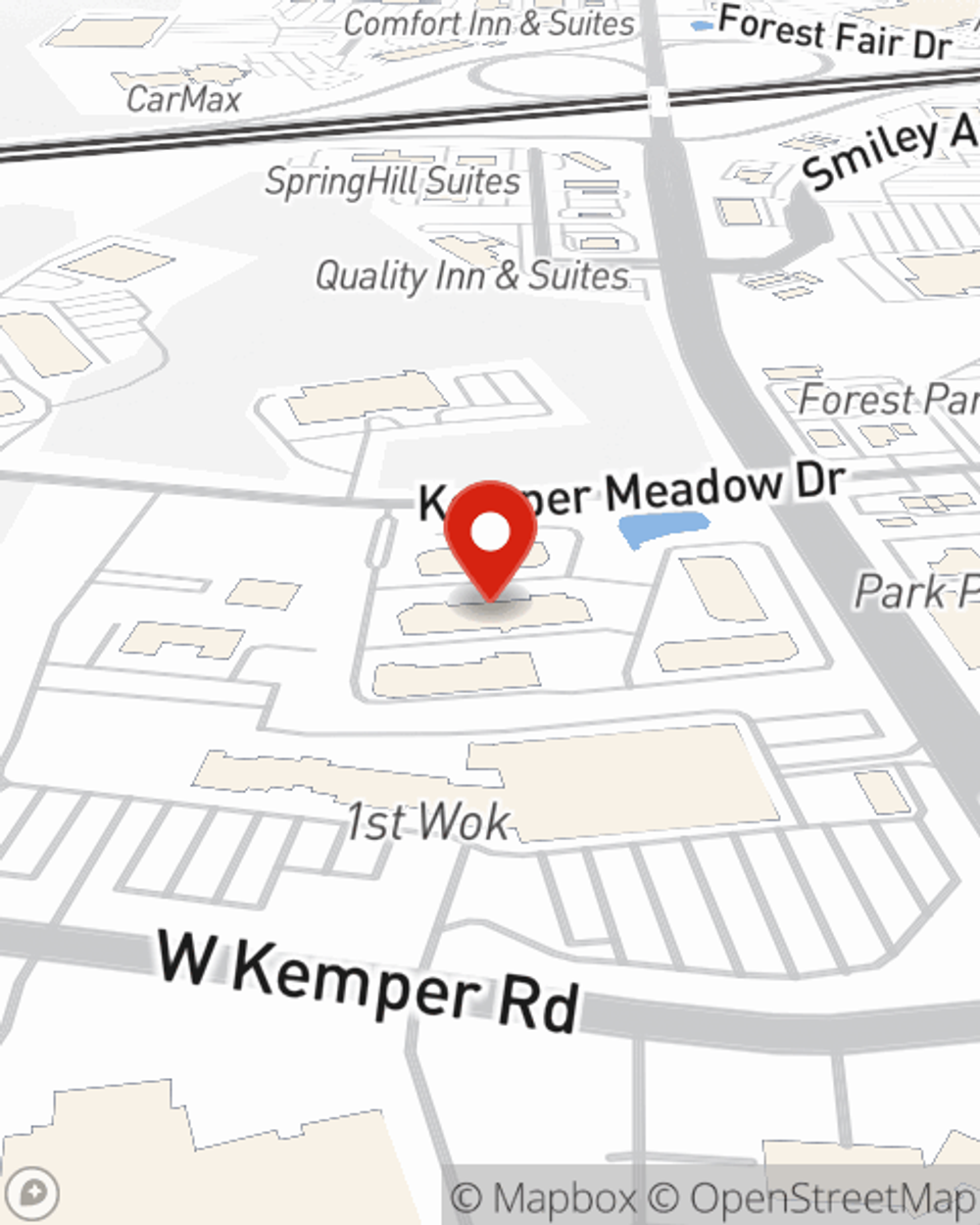

Business Insurance in and around Cincinnati

Get your Cincinnati business covered, right here!

This small business insurance is not risky

Insure The Business You've Built.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Mishaps happen, like a customer hurts themselves on your property.

Get your Cincinnati business covered, right here!

This small business insurance is not risky

Cover Your Business Assets

Being a business owner requires plenty of planning. Since even your most detailed plans can't predict consumer demand or natural disasters. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your hard work with coverage like errors and omissions liability and business continuity plans. Fantastic coverage like this is why Cincinnati business owners choose State Farm insurance. State Farm agent Kent Smith can help design a policy for the level of coverage you have in mind. If troubles find you, Kent Smith can be there to help you file your claim and help your business life go right again.

Do what's right for your business, your employees, and your customers by calling or emailing State Farm agent Kent Smith today to research your business insurance options!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Kent Smith

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.